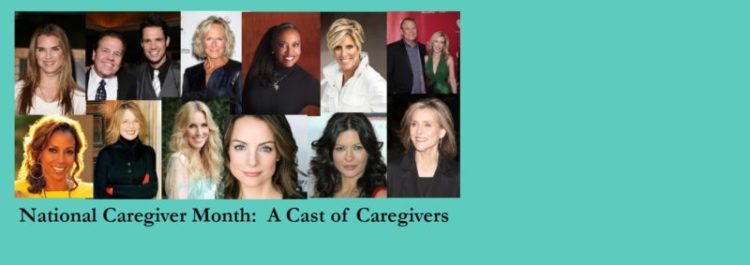

As we celebrate National Caregiver Month this November and recognize the more than 65 million caregivers in the U.S., we prove one point – caregiving crosses all socioeconomic, racial, ethnic, religious borders and even includes some celebrities. Many people feel that...

Suze Orman

Suze Orman Shares Her Cost of Caregiving Story

Sherri Snelling talked to America's financial goddess, Suze Orman, and found when it comes to caregiving, we all face challenges with money. Read Suze's story as caregiver to her mom and what she learned about the costs of long-term care. You can also read this...

Suze Orman’s Lessons Learned on Long Term Care

Sherri Snelling talked to America's financial goddess, Suze Orman, and found when it comes to caregiving, we all face challenges with money. Read Suze's story as caregiver to her mom and what she learned about the costs of long-term care. You can also read this...

PBS Next Avenue Articles

Following are all of Sherri's articles for PBS Next Avenue: 4 Forecasts for Family Caregivers in a Post-Pandemic World 5 Ways to Find Happiness As a Caregiver 9 Ways Caregivers Can Get a Free Respite Break 17 Essential Books for Caregivers 90-Year-Old Billionaire...

Forbes Articles

Following are Sherri's articles for Forbes.com: Alzheimer’s Epidemic Hits Women Hardest B. Smith & Dan Gasby on Alzheimer’s Caregiving is a Corporate Issue Caregiver Tipping Points Casey Kasem’s Legacy for Caregivers Dark Side of Caregiving David Murdock –...

Suze Orman’s Lessons About Long Term Care After Caring for Her Mom

America's financial guru, Suze Orman dispenses expert advice via TV, radio, her books and her Web site on how to manage your money and make it work for you. But when she became a caregiver to her mother, she learned even experts encounter challenges that can cost...

Celebrity Spotlight

Caregiving Club CEO, Sherri Snelling, interviews celebrities from movies, TV, Broadway, sports, news, music and politics who are or have been a family caregiver. In November we honor all the nation's caregivers - those caring for older parents or family members, those...